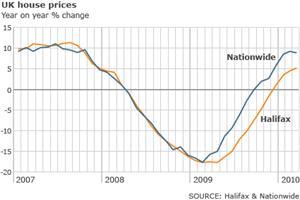

HOUSE PRICE INFLATION HITS 10.

5% The annual rate of UK house price inflation has hit double figures for the first time since June 2007, according to the Nationwide.

The building society said that house prices in the UK had risen by 10.

5% in the year to the end of April.

Prices rose by 1% in April to push the cost of the average home to £167,802.

However, the Nationwide predicted that the past year's surge in prices would tail off later this year, with sellers starting to outnumber buyers.

"There has recently been evidence of a slight shift in the supply-demand balance," said Martin Gahbauer, the Nationwide's chief economist.

"While the recovery in new buyer enquiries at estate agent offices appears to have petered out, the last few months have seen an increase in the level of new instructions from sellers.

"All else equal, this should lead to a gradual flattening out of the recent upward price momentum," he said.

'Subdued mortgage market' The building society's figures show that prices in the past three months were just 1.

1% higher than in the preceding three months.

Continue reading the main story The strong rebound in house prices over the last year has taken place within the context of a subdued mortgage marketMartin Gahbauer Nationwide chief economist That was the slowest three-month on three-month rate since June last year and reflects the fact that much of the annual increase in prices has been due to the rebound in prices that took place last summer.

Despite the revival in prices, which has taken many commentators by surprise, activity in the property market is still relatively subdued.

This has been due to the enforced rationing of mortgage funds provoked by the credit crunch and the banking crisis that started in 2007.

This means the average first-time buyer still has to put down a 25% deposit to secure a mortage.

The most recent figures from HM Revenue & Customs (HMRC) showed that completed sales in the UK jumped by 22% in March from the month before to 72,000.

However, apart from last year, that was the lowest March figure since the HMRC's current records started in 1978.

"The strong rebound in house prices over the last year has taken place within the context of a subdued mortgage market, with the number of mortgage advances across the industry still well down on pre-crisis 'norms'," Mr Gahbauer said.

Share on social media