HOUSE PRICES RISE 0.

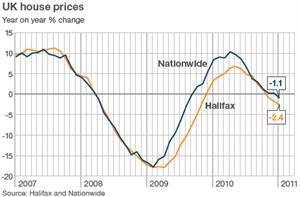

8% IN JANUARY 2011 UK house prices rose by 0.

8% in January compared with the previous month, according to figures from the Halifax.

But the lender, now part of the Lloyds Banking Group, said that prices had fallen 2.

4% compared with a year earlier.

The typical home in the UK now cost £164,173, it said.

Overall during 2011, the lender is expecting little change in property values, although others have predicted prices to dip.

"We expect limited movement in house prices overall this year.

There are, however, likely to be some monthly fluctuations with the risks on the downside," said Halifax's housing economist Martin Ellis.

Mr Ellis had said previously that activity in the housing market during December had been hit by the snowy weather, causing a sharp fall.

"The prospects for the market in 2011 are closely aligned with the performance of the wider economy.

Consumer confidence has fallen recently, partly as a result of nervousness about the economic outlook," Mr Ellis added.

Affordability Prices in the three months to the end of January were 0.

7% lower than the previous three months, the lender said.

These falling prices in recent months, as well as low interest rates, have caused a greater reluctance among homeowners to put their homes on the market, Mr Ellis said.

"This development should help to relieve downward pressures on prices as long as it is sustained," he said.

"We also expect interest rates to remain very low for some time, supporting a favourable affordability position for many existing mortgage borrowers and those entering the market.

"Rival Nationwide Building Society published its house price survey earlier in the week.

Although its month-on-month calculation showed a slight fall of 0.

1% in January, the general picture was very similar.

It also forecast that house prices would stay static or drift a little lower during 2011.

The month-on-month comparison is calculated slightly differently by the two lenders.

If Halifax were to calculate a direct comparison between January 2010 and January 2009, it would show a 2.

5% fall.

However, it uses a smoothed-out quarterly comparison to calculate annual changes.

The Land Registry's survey, considered to be the most comprehensive but which lags behind other house price data, suggested that movements in house prices in England and Wales in 2010 had been affected by geography.

Regions in the south of England saw prices rise over the year, led by a 6.

2% increase in London, it said.

But the value of homes dipped in northern regions, with the biggest fall of 3.

3% in the North East.

Share on social media